3 hours ago (Jul 24, 2017 17:20)

© Reuters. FOREX-Euro settles near two-year highs; outlook bullish

© Reuters. FOREX-Euro settles near two-year highs; outlook bullish * PMI data helps broader euro zone story; FX eyed

* Bets on a weaker dollar rise to highest since Feb 2013

* Graphic: World FX rates in 2017 http://tmsnrt.rs/2egbfVh

By Saikat Chatterjee

LONDON, July 24 (Reuters) - The euro rose to a 23-month high against the dollar on Monday as investors remained bullish after latest business growth data for July pointed to only a mild slowdown, suggesting the euro-zone economy was still growing at a relatively strong clip.

IHS Markit's Euro Zone Flash Composite Purchasing Managers' Index for July, seen as a good guide to economic growth, fell to 55.8 from June's 56.3, still comfortably above the 50 level that separates growth from contraction. data calmed some concerns that the euro's strength this year has hurt growth prospects in the euro zone.

In a note after the data, Citigroup (NYSE:) strategists said "the level of the composite PMI remains high and its sub-components, i.e., strong job creation, firms' sustained optimism and solid pace of activity in services, suggest continued resilience of the euro area recovery".

The single currency was trading at $1.16465, slightly below a high of $1.16840 hit earlier in the day, a level last seen in August 2015. It is the best performing pair in the G10 FX space, up more than 10 percent so far this year.

The euro's rise has also not invited criticism from policymakers, prompting some investment banks to come out with bullish calls. JP Morgan, for example, recommends staying long euros and buy short-dated FX calls vs the U.S dollar.

European Central Bank President Mario Draghi said on Thursday that financing conditions remained broadly supportive, and noted that the euro's appreciation had "received some attention". However, he did not cite that as a problem nor did he directly try to talk the currency down. market positioning also paint a bullish outlook for the euro. One year risk-reversals EUR1YRR=FN on the euro are nearing their highest levels since October 2009.

In contrast, the U.S. dollar has been hit by softening US yields and weak data.

Speculative "short" bets against the U.S. dollar reached the highest since February 2013 NETUSDALL= last week, according to calculations by Reuters and Commodity Futures Trading Commission data released on Friday.

"A weaker dollar seems to be the path of least resistance given the soft data coming out of the U.S. and the political uncertainty," said Michael Hewson, chief markets strategist at CMC (NS:) Markets in London.

On Monday, the , measuring the currency's strength against a basket of other currencies, fell to 93.823, its lowest level since June 2016. It recovered somewhat to be up 0.1 percent on the day at 93.96.

Investigations into alleged Russian meddling in the 2016 U.S. presidential election and whether there was collusion with President Donald Trump's campaign are viewed as obstacles to the administration's plans to boost economic growth and a negative for the dollar. expect little relief for the dollar in a week marked by the U.S. Federal Reserve's regular meeting on policy, with the index on track to test the June 2016 lows of 93.451

For Reuters Live Markets blog on European and UK stock markets see reuters://realtime/verb=Open/url=http://emea1.apps.cp.extranet.thomsonreuters.biz/cms/?pageId=livemarkets

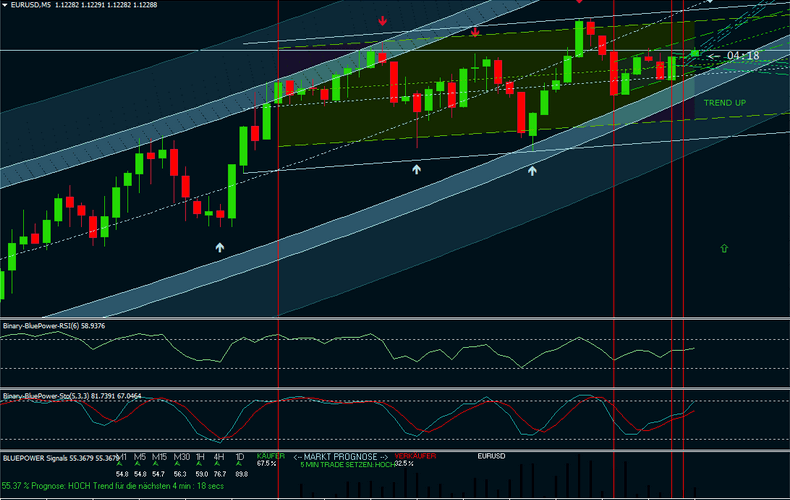

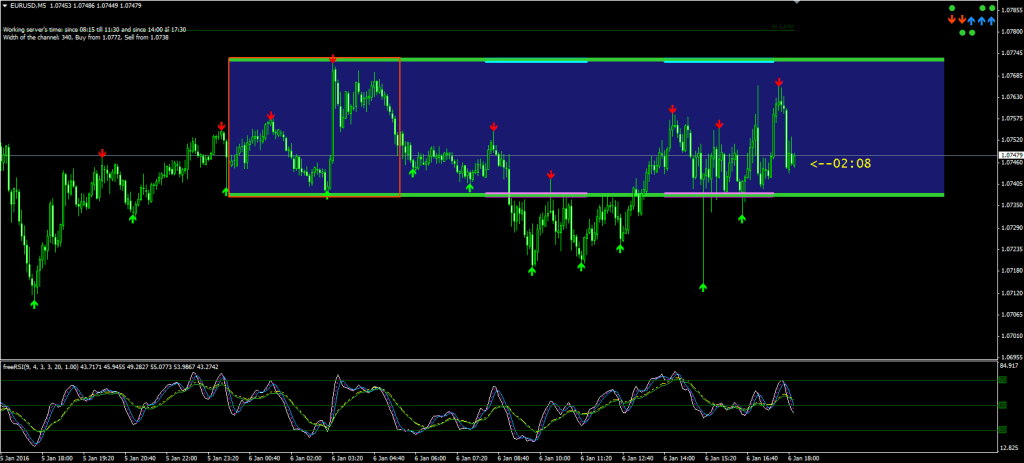

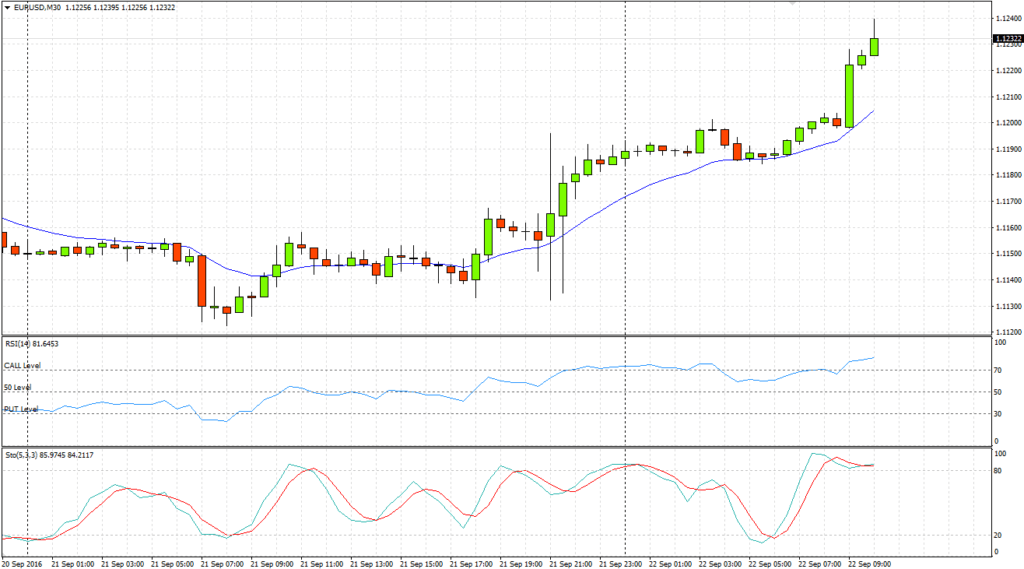

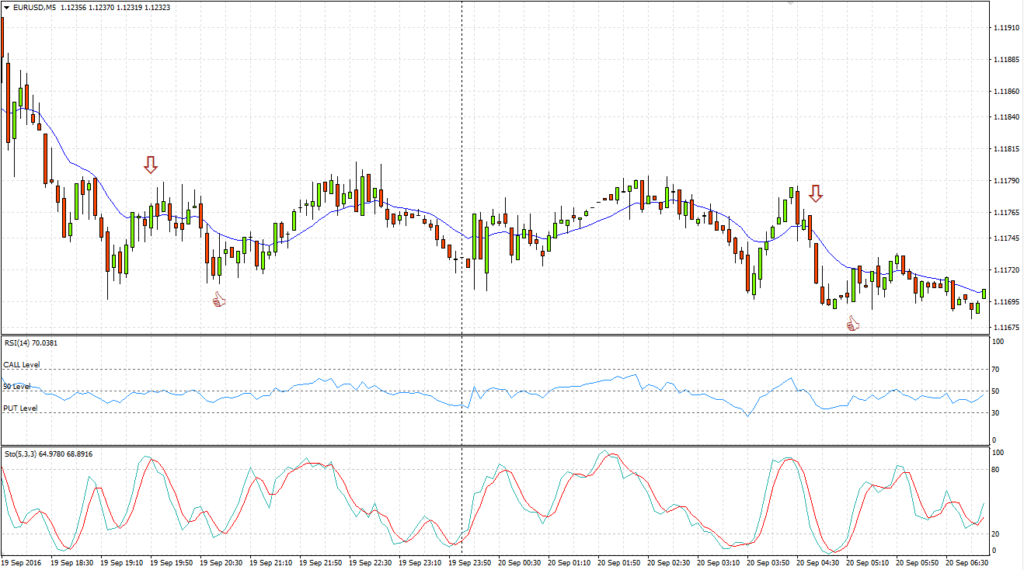

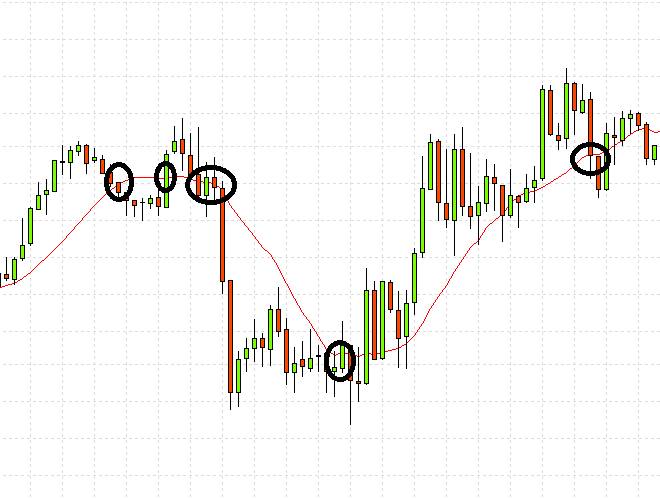

Like other brokers, this option too offers a wide range of assets from different parts of the world. However, not to forget, all assets are born equal. If there is any asset that can assist you standing out in the crowd and become very successful, then it is the EUR/USD currency pair. It allows the traders to invest in Euro in connection with the U.S. dollar. Moreover, it offers the highest payout.

Precisely, EUR/USD is the flagship asset of IQ Option. While advertising their highest average payout, they make sure to use this currency pair. So, when you are close to earn profit, but can’t because of your present assets, then focus on this currency pair. By doing that you might be able to better your trading.

Like other brokers, this option too offers a wide range of assets from different parts of the world. However, not to forget, all assets are born equal. If there is any asset that can assist you standing out in the crowd and become very successful, then it is the EUR/USD currency pair. It allows the traders to invest in Euro in connection with the U.S. dollar. Moreover, it offers the highest payout.

Precisely, EUR/USD is the flagship asset of IQ Option. While advertising their highest average payout, they make sure to use this currency pair. So, when you are close to earn profit, but can’t because of your present assets, then focus on this currency pair. By doing that you might be able to better your trading.

3 hours ago (Jul 24, 2017 17:20)

3 hours ago (Jul 24, 2017 17:20)